Page 79 - MPA ANNUAL REPORT 2016-2017

P. 79

DRIVEN BY PASSION AND PRIDE

MAURITIUS PORTS AUTHORITY

NOTES TO THE FINANCIAL STATEMENTS FOR THE PERIOD ENDED 30 JUNE 2017

3. FINAN CIAL RI SK MANAGEMENT

3.1. Financial Risk Factors

The Auth ority’s ac tivities e xpose it to a vari ety of fin ancial risks, including:

• Foreign exchange risk;

• Credit risk;

• Price risk;

• Liquidity risk; and

• Interest rate risk.

The Authority’s overall risk management programme focuses on the unpredictability of financial markets and seeks

to minim ise poten tial adve rse effe cts of the Authori ty’s finan cial performance.

A descrip tion of th e signifi cant risk factors i s given b elow tog ether wi th the ris k manag ement p olicies applicable.

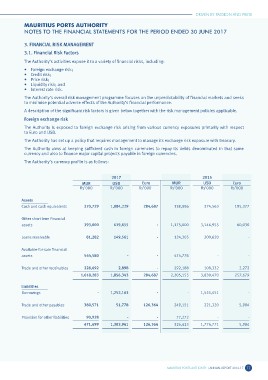

Foreign exchange risk

The Authority is exposed to foreign exchange risk arising from various currency exposures primarily with respect

to Euro and USD.

T he Auth ority has set up a policy th at requi res mana gement to manag e its exc hange ri sk expos ure with treasury.

The Authority aims at keeping sufficient cash in foreign currencies to repay its debts denominated in that same

currency and also to finan ce major capital p rojects payable in foreign currencies.

The Authority’s currency profile is as follows:

MUR 2017 Euro MUR 2015 Euro

Rs’000 USD Rs’000 Rs’000 USD Rs’000

Rs’000 Rs’000

370,729 138,886 195,377

Assets 1,084,229 284,687 374,563

Cash and cash equivalents 393,000 1,175,000 60,030

81,282 619,655 - 124,305 3,146,955 -

Other short term financial 149,561 - 200,620

assets 544,580 474,776 -

228,692 - - 292,188 - 2,272

Loans receivable 1,618,283 2,898 - 2,205,155 108,332 257,679

1,856,343 284,687 3,830,470

Available-for-sale financial - - -

assets 380,571 1,252,163 - 249,151 1,555,451 5,984

51,778 126,364 221,320

Trade and other receivables 90,928 - 77,272 - -

471,499 - 326,423 5,984

1,303,941 126,364 1,776,771

Liabilities

Borrowings

Trade and other payables

Provision for other liabilities

MAURITIUS PORTS AUTHORITY | ANNUAL REPORT 2016-17 77